Galimberti and Woods divided the project into three strands to convey these ideas: a metaphorical strand tells the story of the tax havens; a journalistic strand uses captions to convey key information about the people and structures of tax avoidance; and a final strand shows what these places look like. The idea was to get beyond the glamorised stereotype of the palm- fringed island paradise and show the functional side of tax avoidance. “You have to show what these places look like, that some of them, such as Delaware, are extremely bleak or extremely uninteresting. And in these places literally billions of dollars go through the accounts in ugly, badly decorated offices.”

In doing this, Galimberti and Woods have created images that show what lies behind the façade; a flock of seagulls flying over a ragged towel bearing an image of a $100 bill on a beach near Delaware, children swimming in a beautiful seawater pool amid the mud and rocks of a Jersey beach, or the racks of bicycles beneath the mass of a steel-and-glass corporate headquarters in Amsterdam.

But there are also more complex images in the book, for which Galimberti and Woods had to find ways of combining the literal and the metaphorical to convey a visual message. “One example of how we did this was in Panama,” says Woods. “We were in an apartment in a 50-storey building, but most of the apartments were empty. And all around us there was construction – there were skyscrapers coming up like mushrooms. They were all new but they were also empty. Because the thing that was fuelling this building boom was money coming in from outside, [reportedly] mainly drug money from Colombia and Venezuela. The money comes to Panama, and they invest it in property.

“This property boom is not for people who are living there, it’s like a bank account that is a money-laundering scheme. So how do you show this? Eventually we made this picture of a lady at the top of a hotel, which is Trump Towers, and she’s sitting in a swimming pool looking at the skyline at sunset. But all the skyscrapers are dark, they’re not lit up. So you see this beautiful sunset scene and then you read the caption, which explains the reason those skyscrapers are dark is because they are there to launder money, they’re not for people living there. So you go back to the image and have a different reading of it. That’s the way it works.”

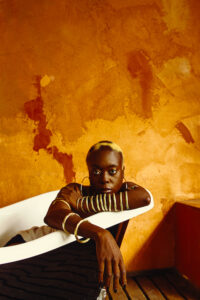

And while The Heavens includes evocative photographs of places, the majority of the shots show the people who serve the infrastructure that supports tax avoidance. “In Jersey we have an image of one of the biggest investors in online gambling, in Delaware we have the chief deputy secretary of state,” says Woods. “He’s been very prominent in bringing Delaware to where it is today as a tax haven [it took Galimberti and Woods 15 minutes to set up their own non-tax paying company called The Heavens in Delaware]. And in Cayman we have the islands’ ex-[acting] governor, who is today the head of Cayman Finance. In every situation we have the more metaphorical or symbolic images but we also have the more journalistic images. Which is extremely important for us because, although there is an artistic element to it, it is at heart very journalistic.”

Galimberti and Woods say the main reward for the project has been the public response to the book, published by Dewi Lewis Media, and the exhibition, which was shown at Les Rencontres d’Arles in 2015. “We have been really astonished by the reaction,” says Woods. “Something like 60,000 people visited the exhibition in Arles. They would stay for a long time and read all the captions – and people aren’t used to captions as long as the ones we have. There was an outpouring of enthusiasm, and not necessarily from people from the photographic world but from the Ordinary Joe, who would come up to us and say: ‘Thank you for telling us this, we had no idea’.”

To see more work from the series, see their INSTITUTE page.

First published in our February 2016 issue, Shooting the Rich, focusing on photographers documenting the 1%. Buy the issue here.